| TEL:

+86 510 82123195

|

| Mobile: |

+86 18168862789

|

| FAX:

+86 510 84602998

|

| Email: |

info@kingluxlens.com

|

| MSN:

kingluxlens@hotmail.com

|

| Skype:

kingluxlens

|

| Q Q:

2852820700,2852820701,2852820699

|

|

|

| |

LED Industry News

|

Current Location: Home >

News >

LED Industry News

|

|

2015 Chinese COB LED Market Rankings by Revenue Led by Oversea Manufacturers

|

|

2015 Chinese COB LED Market Rankings by Revenue Led by Oversea Manufacturers

According to the 2016 Chinese LED Chip and Package Industry Market Report by LEDinside, a division of TrendForce, the market scale of China’s LED package reaches 2% year on year (YoY) growth at US $8.8 billion in 2015. The COB LED market has witnessed rapid growth over the past few years. An apparent example is that COB LEDs are gaining higher penetration rate in high-end commercial lighting applications. Meanwhile, outdoor illumination market also finds COB LED packages’ growing penetration rate. Therefore, more and more manufacturers enter the COB LED market. Aside from international manufacturers that entered the market in the early stage, including Citizen, Sharp, Bridgelux and Luminus Devices, leading manufacturers like CREE, Lumileds and Nichia also tapped into the market of COB LEDs. The number of Chinese manufacturers that entered COB LED package market is even higher, including Sunpu Opto, Guangzhou LEDteen Optoelectronics Co., Shenzhen Crescent Optoelectronic Co. and Shenzhen Tongyifang Optoelectronic Technology co. With more players entering the industry, the market has also witnessed huge change. Overall, international manufacturers are still dominant in China’s COB market.

|

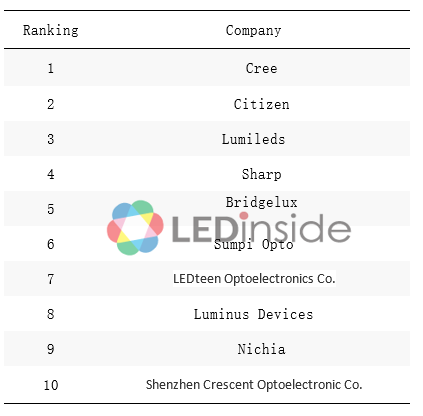

Table Chinese COB LED manufacturers’ market rankings

|

|

|

Source of Data: LEDinside

|

Citizen is the leading manufacturer in COB LED market around the world. However, ever since Cree launched its COB lineup in Chinese market, the company’s market share continued to climb as it took advantage of existing distribution channels and the competiveness of its products. Cree topped the global COB LED manufacturer rankings in 2015. Due to fierce market competition, the revenue growth of Citizen’s products slowed down in Chinese market but remained at a relatively high market share in high-end market.

Ever since Lumileds released COB products in 2013, the company saw rapid development in commercial lighting market. Lumileds climbed to the third place in the 2015 COB LED manufacturer rankings. The company largely expanded its COB production line recently and it’s expected that it will witness rapid growth in revenue income as of 2016.

Both Sharp and Bridgelux saw declining revenue income as other Chinese manufacturers and international manufacturers gained market share.

Sunpu Opto has been the leading Chinese COB LED manufacturer. The company entered COB LED market ever since it was founded and has been in leading position in terms of brand, technology and production capacity scale. In 2016, the company introduced dual color temperature COB LED that captured the industry’s attention. Meanwhile, Sunpu Opto also provided special lighting applications, including COB LEDs for horticultural lighting.

Guangzhou LEDteen Optoelectronics Co. focuses on COB LED market ever since it was founded. The company saw rapid growth over the past few years. In 2016, Guangzhou LEDteen Optoelectronics launched high-density, high CRI products that boost its competitiveness in high-end commercial lighting market. Luminus Devices mainly positions itself in high-end commercial lighting applications. The company was acquired by San’an Opto in 2013. It currently constructs a manufacturing base in Xiamen to scale up production capacity. Therefore, it’s expected to see Luminus Devices’ growth in sales revenue scale in the near future.

Nichia introduces COB products to Chinese market for a short period of time only but has since witnessed rapid growth. In 2016, the company’s market share saw rapid increase thanks to its high price-performance products. It’s projected that the company will see exponential growth in sales revenue.

Shenzhen Crescent Optoelectronic mainly manufactures high-power LED packages, including COB and other high-power LED products and that it has been accumulating experience in specific market segment. In 2015, the company’s COB LED revenue income ranked the tenth.

LEDinside 2016 Chinese LED Chip and Package Industry Market Report

Release: 30 June 2016

Language: English

Format: PDF

Page: 246

-

Chapter I: Chinese LED package market scale in 2015-2020 are forecast; Chinese LED package market scales by market camps (international / CN / TW) and power type in 2015-2020 are analyzed; top 10 LED package manufacturers revenue in China

-

Chapter II: Market segments are discussed; Chinese backlight LED, lighting LED, and display LED market scales in 2015-2020; product specification requirement in backlight, lighting, display; Chinese top 10 manufacturer revenue ranking in backlight, lighting, and display

-

Chapter III: Merge and acquisition cases in 2014-2015 are compiled and analyzed (cases study, reason alanysis, impacts)

-

Chapter IV:20 Chinese LED package manufacturers are analysis, covering revenue, operating activities, capacity expansion plan, major customers, and LEDinside perspective

-

Chapter V: 17 International and Taiwanese manufacturers are surveyed, covering revenue and profit, business in China, operating activities, major products and major customers.

-

Chapter VII:16Upstream LED chip manufacturers are introduced, covering market forecast, policy subsidies, manufacturers introduction, supply chain, and operating business

-

Market:Market opportunities and challenges in China are discussed

-

Company:Chinese LED package manufacturer product, technology, expansion plan, future development are discussed

-

Strategy:International and Taiwanese LED package manufacturers opportunities and challenges in China

Chapter I Chinese LED Package Industry Overview

-

Chinese LED Package Industry Developments

-

2015-2020 Chinese LED Package Market Size

-

2015-2020 Chinese LED Package Market Size By Market Camps

-

2015-2020 Chinese LED Package Market Size By Power Types

-

Top 10 LED Manufacturers Revenue Ranking in China

Chapter II Chinese LED Market Segments- Market Scale, Market Shares, Product Specifications, Supply Chain, and LED Manufacturers' Rankings by Applications

-

Smartphone Backlight and Flash LED Markets

-

Middle and Large-Sized Backlight Market

-

Lighting Market

-

Display Market

-

Market Trend and Scale

-

Product Requirement

-

Supply Chain Analysis

-

Top 10 Chinese LED Manufacturers Ranking- Backlight, Lighting, Display

Chapter III 2015 Market Issue: Marge and Acquisition Case Analysis

-

Major Mergers & Acquisitions Cases

-

Causes for Mergers & Acquisitions

-

Impacts on Mergers & Acquisitions on Package Industry

Chapter IV Major Chinese LED Package Manufacturers Analysis

-

NationStar

-

Honglitronic

-

Refond

-

Jufei

-

Mason

-

ChangFang Lighting

-

MLS

-

Kinglight

-

Smalite

-

Hkled

-

Wenrun

-

Dongshan Precision

-

Lightning Opto

-

Runlite

-

Shineon

-

MTC

-

APT

-

Glorysky

-

Sunpu

-

JIUZHOU

Content

-

Revenue and Profit

-

Product Mix

-

Production Capacity Expansion Plan

-

Business Summary for 2015

-

Profitability Analysis

-

Operating Analysis (Days sales of inventory, Days of Sales Outstanding)

-

Debt Paying Ability Analysis (Debt-Assets Ratio)

-

Product Specification

-

Overall Evaluation

-

-

Product

-

Technology

-

Scale

-

Main Customers

-

LEDinside’s Perspective

-

Note: Not specified currency in this chapter regarded as RMB

-

Note: Capacity is from company source

Chapter V International LED Manufacturers Business Activities in China

-

European and U.S. LED Manufacturers Operating Activities in China

-

Lumileds, Osram Opto, Cree, Luminus Devices

-

Japanese LED Manufacturers Operating Activities in China

-

Korean LED Manufacturers Operating Activities in China

-

Samsung LED, LG Innotek, Seoul Semiconductor

-

Taiwanese LED Manufacturers Operating Activities in China

-

Everlight, Lite-on, Lextar, Unity Opto, AOT, Harvatek, Edison Opto, Brightek

-

Company Profile, Product and Business Strategy

-

Revenue and Gross Margin

-

Revenue from Chinese Market and Share

-

Major Clients in China

Chapter VI China’s LED Package Manufacturers Competitiveness

-

Chinese and International Manufacturers’ Competitiveness

-

China’s Domestic Manufacturers Competitiveness

-

Maturity in The Industry

-

Industry Concentration

-

Industry Integration Trend

-

Industry Growth Opportunities and Threats

Chapter VII Chinese Chip Market Analysis

-

Chinese LED Chip Market Overview- Policy Subsidies, Government Support, Capacity Expansion Plan

-

Chinese LED Chip Market Scale Analysis- Global Market Scale, Global Market Share By Region, Players Market Share in China

-

Chinese Chip Manufacturers Analysis

Chapter VIII Conclusions and Suggestions

|

|

|